In the glory days of the five years after the turn of the Millennium, where we had double-digit house price growth, mortgage companies (notably Northern Rock, HBOS and their ilk) desperate to get on the buy to let mortgage bandwagon with rates so low it would make the belly of a snake seem high and an open mildness to give loans away with not so much more than a note from your Mum and with hardly any regulatory intervention… anyone could make money from investing in property – in fact it was easier to make money than fall off a log! Then we had the unexpected flourish of the property market, with the post credit crunch jump in the property market after 2010, when everything seemed rosy in the garden.

Yet, over the past five years, the thumbscrews on the buy to let market for British (and de facto) Huddersfield investors have slowly turned with new barriers and challenges for buy to let investors. With the change in taxation rules on mortgage relief starting to bite plus a swathe of new rules and regulations for landlords and mortgage companies, it cannot be denied some Huddersfield landlords are leaving the buy to let sector, whilst others are putting a pause on their portfolio expansion.

With the London centric newspapers talking about a massive reduction in house prices (mainly in Mayfair and Prime London – not little old Huddersfield) together with the red-tape that Westminster just keeps adding to the burden of landlords’ profit, it’s no wonder it appears to be dome and gloom for Huddersfield landlords … or is it?

One shouldn’t always believe what one reads in the newspaper. It’s true, investing in the Huddersfield buy to let property market has become a very different ballgame in the last five years thanks to all the changes and a few are panicking and selling up.

Huddersfield landlords can no longer presume to buy a property, sit on it and automatically make a profit

Huddersfield landlords need to see their buy to let investments in these tremulous times in a different light. Before landlords kill their fatted calves (i.e. sell up) because values are, and pardon the metaphor, not growing beyond expectation (i.e. fattening up), let’s not forget that properties produce income in the form of rent and yield. The focus on Huddersfield buy to let property in these times should be on maximising your rents and not being preoccupied with just house price growth.

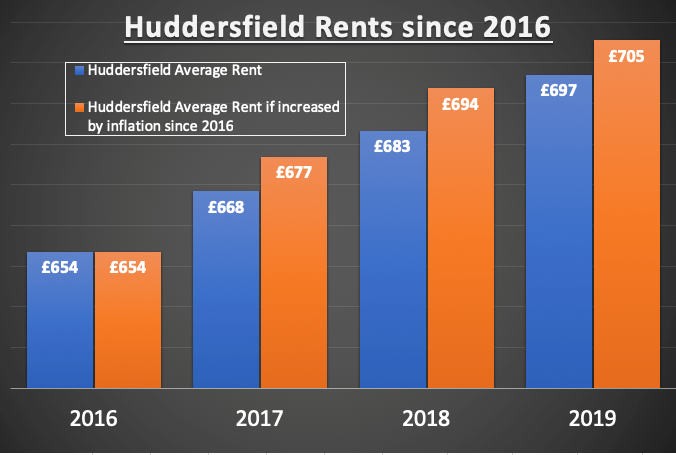

Rents in Huddersfield’s private rental sector increased by 2.02% in the past 12 months

Rents in Huddersfield since 2008 have not kept up with inflation, it is cheaper today in REAL TERMS than it was 11 years ago and some landlords are beginning to realise that fact with our help.

Looking at the last few years, it can be seen that there is still a modest margin to increase rents to maximise your investment (and it can be seen some Huddersfield landlords have already caught on), yet still protect your tenants by keeping the rents below those ‘real spending power terms’ of the 2008 levels.

Buy to let must be seen as a medium and long-term investment ….

Rents in Huddersfield are 6.66% higher than they were 3 years ago and property values are 11.49% higher than Jan 2016

…and for the long term, even with the barriers and challenges that the Government is putting in your way – the future couldn’t be brighter if you know what you are doing.

Investment is the key word here… In the old days, anything with a front door and roof made money – yet now it doesn’t. Tenants will pay top dollar for the right property but in the right condition. Do you know where the hot spots are in Huddersfield, whether demand is greater for 2 beds in Huddersfield or 3 beds? Whether town centre terraced houses offer better ROI than suburban semis? With all the regulations many Huddersfield landlords are employing us to guide them by not only managing their properties, taking on the worries of property maintenance, the care of property and their tenants’ behaviour but also advising them on the future of their portfolio. We can give you specialist support (with ourselves or people we trust) on the future direction of the portfolio to meet your investment needs (by judging your circumstances and need between capital growth and yields), specialist finance and even put your property empire into a limited company.

If you are reading this and you know someone who is a Huddersfield buy to let landlord, do them a favour and share this article with them – it could save them a lot of worry, heartache, money and time.